Wish, or Wish.com, is an American online e-commerce platform founded in the Silicon Valley in 2010 by Piotr Szulczewski (CEO) and Danny Zhang (former CTO), operating in San Francisco. Wish provides inexpensive, direct-to-consumer products at the lowest possible price. It allows sellers to directly list their products on Wish, creating a gateway between Chinese brands and Western consumers. It is an open, direct-to-consumer app ideal for Chinese brands selling in the west.

How does Wish.com help Chinese brands reach western consumers?

One of the advantages of selling on Wish over other western e-commerce platforms is that rather than relying on a search function, they choose to personalize shopping visually for each customer by utilizing browsing technologies. Other advantages are that they work with payment services providers to handle payments, don’t stock the products, and don’t manage the return. In other words, Wish only connects buyers and sellers but is not directly involved in any transaction between them.

Wish is just an intermediary. This gives opportunities to brands by allowing them to reach western consumers while keeping their marketing budget to a minimum.

How to sell on Wish

- Go to the Wish for Merchants registration page, enter your store name, email address and make a password.

- Confirm the account on your email

- Enter brand authorizations by uploading a document to prove Trademark License, Proof of Patent, Copyright Ownership or other.

- Upload products and choose relevant categories

- Confirm fulfillment options, between in-house, fulfillments by Wish, or outsources fulfillment.

- Enter payment info and select payment gateways

- The products will need to be approved by Wish

Taking Wish sales to the next level, get a Wish Verified badge

A Wish verified badge is a blue-circled checkmark that appears on products from sellers deemed trustworthy. Wish evaluates products periodically on trustworthiness, and sellers can lose their badge if they do not continue to meet the standards. Wish’s verified store standards include:

- Low refund ratio

- High product ratings

- High sales

Why sell on Wish.com

Wish’s success in the US and Europe

Wish sells about three million items a day, about a third of which are for consumers in the United States. The company was valued at over $11 billion after its last round of financing in 2019.

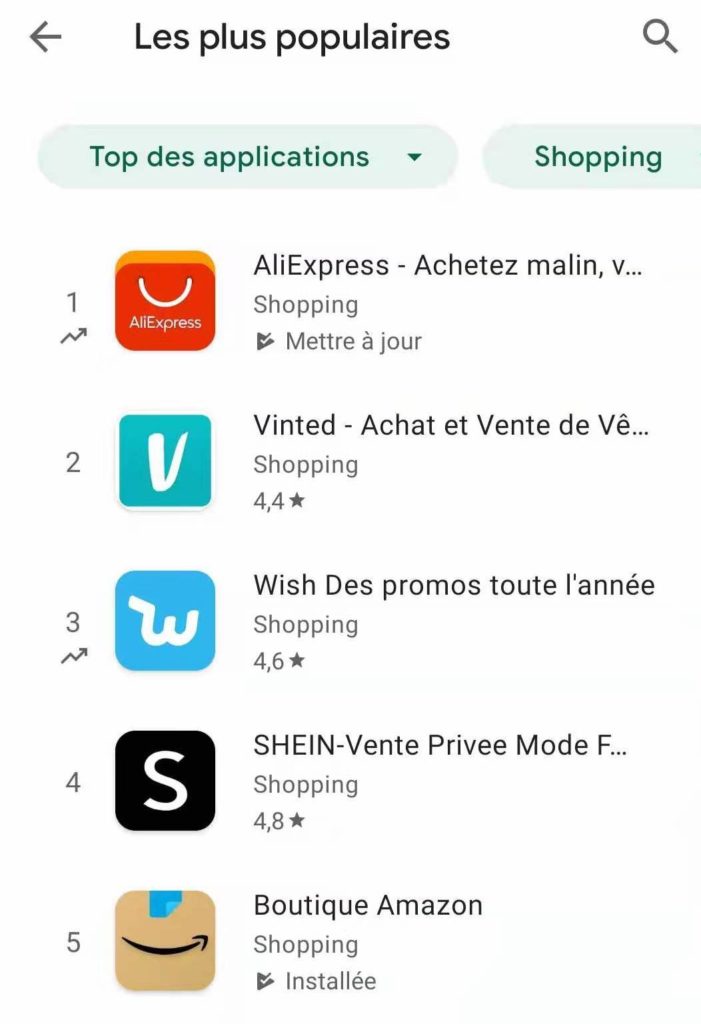

The mobile app is rank number 1 in the category of shopping in roughly 40 countries, in France, it ranks top 3 in the Google play store. The company claims to have 300 million customers around the world in 2017. Wish is now the third-largest marketplace in the world in terms of sales, with nearly 90 million monthly users.

Source: French Google Play Store, Top 5 most popular mobile app for shopping

Wish is a rather user-friendly app for both buyers and sellers. For the sellers, the signup process is simple, and the products get good exposure quickly on the website. The marketplace allows sellers to sell in 78 countries worldwide, with over 200 million items listed on it and approximately 2.4 million orders sold daily.

One of the major points of Wish.com is that it doesn’t charge any fee if a product doesn’t sell. Wish only earns when sellers’ products get sold, therefore, the seller needs to pay fees only when their product is sold. There are no registration fees, no monthly or annual subscription fees, and no fees for listing products. Wish only takes up to 15% commission on each sale, which is calculated by combining the order and shipping rates. It promises a delivery time of 2 to 4 weeks.

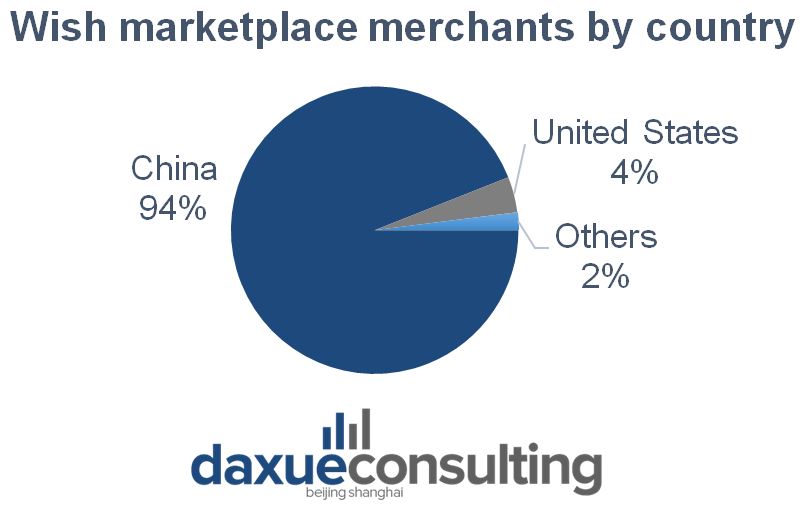

In November 2018, Marketplace Pulse study calculated that 94% of merchants on Wish are based in China. US-based sellers represent 4%, followed by the UK at 0.3%, Canada at 0.2%, India at 0.1% and Australia at 0.1%. Even among international sellers, many products are made in China. All the biggest marketplaces are also full of merchants selling products through intermediaries like dropshippers. Wish, on the other hand, displays the product origin openly.

Data Source: Marketplace Pulse, designed by Daxue Consulting, Wish marketplace merchants by country

Wish targets a set of western consumers that everyone previously neglected

Wish is probably the only mass consumption marketplace that doesn’t try to be like Amazon. That’s what makes it so interesting. EBay, Cdiscount, Rakuten, and more recently Google are all trying the same promise from Amazon: free delivery in two days, a huge catalog, and attractive prices. It implies that all consumers want the same thing and, more importantly, can afford the same thing.

In contrast, Wish targets consumers who prefer price over brand and fast delivery. The promise is to buy the same item at an unbeatable price, without the brand logo, directly from the manufacturer, but with a long delivery time. Wish targets low-income buyers who want a low price and are willing to gamble the quality. It has also a huge base of mobile shoppers that are looking daily for deals on the app. 21% of lower-income shoppers’ access to the internet only on their smartphones, which is higher than the 12% average.

In 2018, Wish became the second e-commerce retailer in France in terms of the number of items sold. From less than 3% of French consumers who bought at least one item on Wish in 2017, it increased to over 15% in 2018. On the French market, Wish.com has touched an audience equals to 16.8% of the population in the second quarter of 2019 with around 10 million visitors per month.

Wish’s marketing strategy makes the brand well known to most young, digital-savvy western consumers

The young generation in the west is attracted to new things, especially when a brand they have found promises them a service that is particularly adapted to their needs. The mechanisms of influence have been greatly changed by social networks. With brilliant campaigns on Facebook and Instagram, users are continuously retargeted with ads for new items sold Wish.

Today, Wish is the second-largest Facebook advertiser in all categories. In other words, the company stands out with an aggressive advertising strategy on social networks such as YouTube, Instagram, Google, and Facebook. For example, during the 2018 World Cup, the website launched an advertising campaign with many football personalities. The cast of the commercial is quite impressive, including Neymar, Paul Pogba, Gareth Bale, Gigi Buffon or Robin van Persie. On TV commercials, 30-second versions were also produced, focusing on each personality and different markets. It is also the jersey sponsor of the Los Angeles Lakers NBA franchise.

Source: YouTube, French footballer Paul Pogba on Wish advertising during the 2018 WorldCup

Wish functions more similar to social media than e-commerce

Wish.com treats consumption like social media. When someone logs onto social media, they are receiving hits of dopamine from random things that end up on their feed. Just like how social media users are not landing on the app to find something specific, Wish users also do not know what products they are going to find, and that’s part of the attraction.

The mobile phone remains the ideal tool for cheap impulse purchases (73.3% of visits are on a smartphone). Mobile shopping is about providing an entertaining experience on an easy interface. Shoppers are browsing, not searching with the intent to buy. 9 out of 10 mobile purchases on Wish.com do not begin with a search query.

Thanks to its functionality and its ability to generate a lot of traffic, the site collects a considerable amount of consumer data. Wish knows what they buy, watch and share. It can offer them products that will interest them with attractive price discounts, which is what their customers love. On top of this, the platform re-targets them on social networks, large audience sites (Outbrain, Criteo), relaunches them by email.

The negatives to selling on Wish: Too much permissiveness leads to future problems

Environmental and overconsumption concerns

The western consumer market is always undergoing dynamic changes, while one side is that many consumer enjoy using an app that provides cheap products for impulse shopping, there is always the other side of the coin. Many westerner consumers increasingly value a brand’s good intentions, ethics, which in-turn slows consumption trends. The opposite of the type of consumption on Wish is capsule wardrobes, which is purchasing fewer, higher quality, and often more organic clothing items. Though they have different target cosumers, this trend is equally as hot as the buzz around Wish.com.

As a nation that spear-heads mindful consumption, many French consumers protests against Black Friday for encouraging overconsumption, and get angry when Amazon products do not comply with orders and denounce the inhumane practices behind ultra-discount offers. Some of them view Wish as a distributor that has all these vices: it encourages overconsumption, offers products of poor quality, and has no statement on production conditions, which at such low prices, is not hopeful.

Source: Trustpilot.fr, Average review on Wish.com as of April 2021

Some products on the website may present real consumer safety problems: makeup, cosmetics, sweets, baby toys which are highly regulated products in the French market.

In 2018, the General Directorate for Competition Policy, Consumer Affairs, and Fraud Control or in French “DGCCRF” investigated by ordering cosmetics at low-cost marketplaces. 65% of the objects it tested were found to be non-compliant with European safety standards, and 38% were even considered dangerous, often times for containing unauthorized ingredients.

Concerns around counterfeit goods

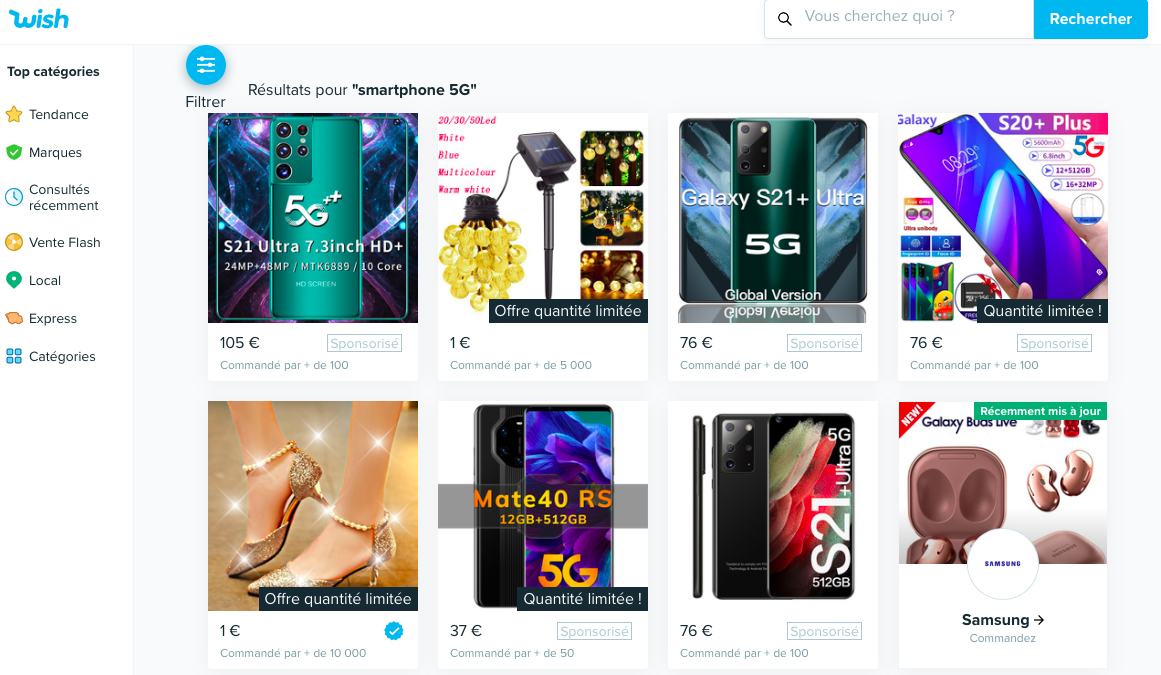

Some consumers seem to be quite comfortable buying counterfeit goods on the French market. According to a 2017 survey, 10% of European consumers said they had already bought them in the past 12 months. The phenomenon is particularly pronounced among young people: 41% of 15-24 years consider it “acceptable to buy counterfeit products when the price of the original product is too high.”

Source: Wish website, smartphone 5g for only 100€ instead of 1000€

Wish vs. AliExpress: The competitors of selling Chinese products in the west

Wish’s business model is easy to replicate, especially with the increase of competitors such as Lightinthebox, Gearbeast, Joom, Vova, or its biggest competitor AliExpress, which is prepared to gain more share on the European market. Alibaba is better equipped than Wish to sort Chinese products that don’t meet French standards.

Both AliExpress and Wish work with Chinese factories, meaning that there is no drastic difference in the quality of products. However, items on AliExpress are relatively cheaper than those on Wish because it takes only 5% of revenue. But, because AliExpress is not based in the west, it loses some credibility. When Wish promotes mostly in the US and Europe, AliExpress focuses more on emerging markets especially Russia and Brazil. Furthermore, on Wish, it is easier to find an international seller but on the other hand, many dropshippers buy their products cheaper on AliExpress then sell them higher on Wish.

What Chinese brands need to know about selling on Wish

Wish has an unstoppable business model: unbeatable prices, it encourages impulsive buying, its customer retention rate is high. And if the quality is not there, it’s not so bad for the price customers paid. Its unique promise feeds its notoriety through word of mouth, the cheapest and most effective marketing.

- Wish uses an aggressive social media advertising strategy to showcase products on their page so the products on the page don’t have to.

- Most of the purchases on Wish.com are price-driven, brand name is not an important factor. Wish is not an ideal place to sell luxury or high-end products.

- It is free to register and list products on the platform, however, the commission fee is 15% compared to 5% of AliExpress.

- The target countries of Wish include North America and Western Europe, compared to AliExpress which targets rising economies.

- However, brands selling on Wish need to be conscientious to the fact that the platform has a low-standing among value-oriented consumers.